The Interest Accrual Global Update - is the main interest option and must be executed in order to accrue interest. It will only accrue interest to TAX debts marked as Interest Accruable.

Frequency: This process can be run at anytime, but is recommended the first business day of the month. If it is not, it can be run any day in the future and a retroactive date entered.

Before Interest Accrual can be executed, the Tools-Administrator-Account Code - Address setting for this Account Code, probably named TAX, must be configured as Interest Accruing.

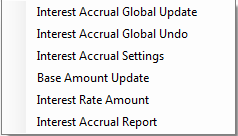

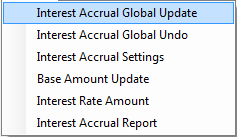

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

- if a debt can accrue interest but is not marked as Interest Accruable, local governments are losing funds as debts may be setoff for less than they could be.

- if a debt can accrue interest but is not marked as Interest Accruable, local governments are losing funds as debts may be setoff for less than they could be.

- create some kind of reminder to execute this monthly to stay current and attempt to collect the highest amount of debts possible. If a month is missed, it can be still be done. Just run and select a day with that month missed. But be sure that month was actually missed.

- create some kind of reminder to execute this monthly to stay current and attempt to collect the highest amount of debts possible. If a month is missed, it can be still be done. Just run and select a day with that month missed. But be sure that month was actually missed.

- if a debt is marked as interest accruing by mistake too much could be taken from their tax refund or lottery winnings.

- if a debt is marked as interest accruing by mistake too much could be taken from their tax refund or lottery winnings.

1. From the Main Menu click Interest:

2. The Interest menu options:

3. Move the mouse over Interest Accrual Global Update and click this option:

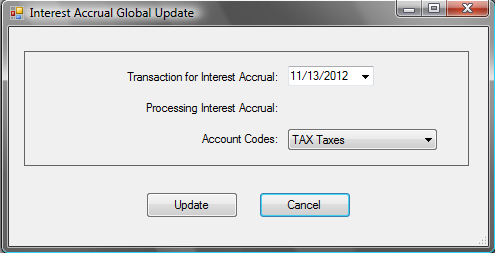

4. A dialog screen appears with the Account Code(s) configured as Interest Accruable in the Tools-Administrator-Account Codes, Address setting:

- it makes no difference in the amount of interest calculated as to what day of the month. as long as the date is in the as to the process or the amount.

- it makes no difference in the amount of interest calculated as to what day of the month. as long as the date is in the as to the process or the amount.

- Click

to abort and return back to the main menu

- Click

to update to permanently remove all debts $0.00

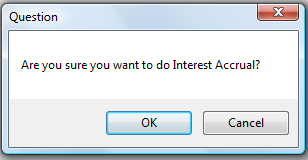

- The following appears:

- Click

to abort the change and return to the selection screen

- Click

to begin the process and when completed the following appears:

- Remember to Print the Interest Accrual Report

- Remember to Print the Interest Accrual Report

6. Click  to return to the Main Menu:

to return to the Main Menu: